femme boss social

Click “Customize” to customize your Buyer Posts. Add the pages you want from the left-hand side (MAX 20 at a time or the Design Center will be very sluggish), then customize the first page with your colors, name, headshot, etc.. Use the corresponding captions for the posts below.

Download the entire set of stock graphics below HERE.

P1

1. Pay more than the minimum.

2. Pay more than once a month.

3. Pay off your most expensive loan first.

4. Consider the snowball method of paying off debt.

5. Keep track of bills and pay them in less time.

6. Shorten the length of your loan.

7. Consolidate multiple debts.

If these all seem overwhelming, start by choosing one and add on one or two more each month. You’ll have that fund built up in no time!

P2

Imagine this: You’ve FINALLY been approved for a mortgage, and can now be a proud homeowner within 3 months. You want to celebrate by buying a new car to complement the driveway you’re about to have. OH NO! You get a call from your lender, and they tell you there’s been a problem with your debt to income ratio and you are no longer approved for a loan.

Just like that, there can be problems after applying for a mortgage if you don’t stay away from these mistakes.

1. Don’t change jobs

2. Don’t make large purchases

3. Don’t close credit accounts

4. Don’t apply for new credit

🏠

P4

When you have great credit, you can get approved for credit cards, loans, and mortgages with low interest rates. But when your credit score is in the toilet, it’s almost impossible to get approved for anything.

There are many different factors that affect your credit score.

Everything from paying off debts to how long you have had an account in good standing will contribute to your credit score.

Some of these factors are out of our control (like medical debt), but there are some things we can do to improve our situation.

These 4 quick tips should help you boost your credit score!

P5

When you are trying to buy a house, it can be hard to get the down payment together. Not everyone has this kind of money lying around. I’m sure that there are some folks out there who don’t have this kind of money sitting in the bank account, waiting for them to use it at their leisure.

So how do you get the cash needed for your down payment if you don’t have it?

This is where a little bit of creativity comes into play!

🏠

P6

You’re finally ready to buy your first home and you want it to be an investment property so that you can have the glorious passive income you’ve always dreamt of.

You’re already one step ahead and making a wonderful decision for your future, however, there are some rules when it comes to first-time homebuyers and investment properties. I know… rules are lame but if you’re planning on using an FHA loan keep reading.

If you buy a home, whether it’s a duplex, or a single family home with an FHA loan you are required to live in it for at least a year. In other words, yes you can still rent it out but you have to use it as your primary residence. A duplex could be the way to go if you want to have your own space but still rent the property out. Have any other questions about FHA loans?

Drop them down below!

✨

P7

Remember when gas prices were low and mortgage rates were at an all-time low? 📉 Well, we also were smack dab in the middle of a pandemic so it goes without saying that mortgage rates will 📈 increase now that things are getting back to normal but 🚫 DON’T SWEAT! 😓

📉 They are still LOWER than they were last year and you can still lock in a great rate today.

🙋♀️ I’ve got the best of the best when it comes to lenders I trust, so contact me today, and let’s get you pre-approved!

P8

Choosing the right lender is like choosing your partner, you want to go with the person that will 📲 communicate, get things done ✅, and is trustworthy ❤️.

So how do you choose the right lender? 🤷♀️

➡️ Shop around- although it’s not the main reason to go with a lender, you want to make sure you’re getting the best interest rates available to you. Shop around and compare rates to save yourself money.

➡️ Get recommendations- Most Realtors have lenders they work with that are reliable to get the job done. Ask around for local lenders.

➡️ Read reviews- reviews can be helpful and help you avoid red flags such as bad communication

➡️ And lastly, ask questions- don’t be afraid to ask questions, ask as many as you can to ensure you are picking the right lender.

I have a few lenders that I work closely with, feel free to reach out to me for an introduction!

P9

There’s nothing more rewarding than building your own business! However, there are times when the perks can be canceled out by the downsides 👎.

1️⃣ of them being, it’s not as easy to obtain a mortgage when you’re self-employed.

But don’t worry! You still can apply for a loan if you can provide proof of income with these documents below:

👉 Two years of personal tax returns

👉 Two years of business tax returns

👉 Business license

👉 Year-to-date profit and loss statement

👉 Balance sheet

👉 Signed CPA letter stating you are still in business

P10

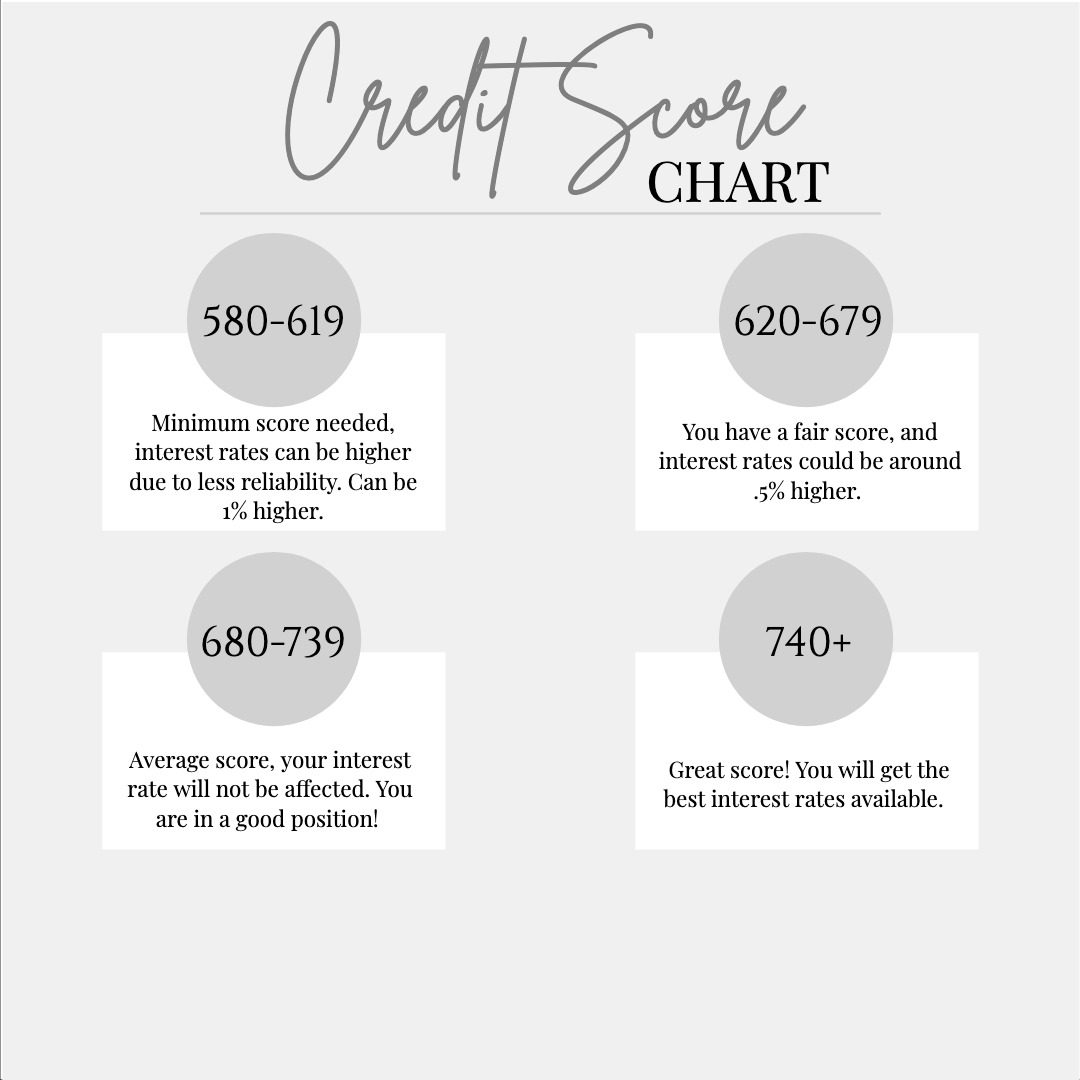

It’s no surprise that higher credit scores put us in better positions, but it’s not the end of the world if you don’t have a perfect score.

❓Do you have a minimum credit score of 580? Then you CAN qualify for a loan!

It’s important to note that you may not get the best interest rate.

📊 Check out this chart that explains what your credit score can get you and don’t hesitate to reach out to me directly for more information. Our lender can get you approved in a few days!

P20

Prequalification is an early step in your home buying journey. When you prequalify for a home loan, you’re getting an estimate of what you might be able to borrow, based on the information you provide about your finances, as well as a credit check.

Preapproval is as close as you can get to confirming your creditworthiness without having a purchase contract in place. You will complete a mortgage application and the lender will verify the information you provide. They’ll also perform a credit check. If you’re preapproved, you’ll receive a preapproval letter, which is an offer (but not a commitment) to lend you a specific amount, good for 90 days.

🌼

P23

BUYERS Tip Time! 🎉

You are more than likely going to have some surprises when some extra expenses appear. Moreover, there are taxes and fees to consider and also maintenance and repair that your home may need.

So the wise thing to do would be to keep some money in a high-interest savings account that’ll help you to earn a few extra dollars while you’re waiting for the whole process to go through. 🔑

P24

Watch out for these 3 “whoopsies” on your credit report.

❌ 𝐃𝐞𝐥𝐢𝐧𝐪𝐮𝐞𝐧𝐜𝐲 𝐨𝐫 𝐔𝐧𝐩𝐚𝐢𝐝 𝐝𝐞𝐛𝐭

This can make the lender think that you’re unable or unlikely to pay your payments on time, or at all.

❌ 𝐓𝐨𝐨 𝐦𝐚𝐧𝐲 𝐢𝐧𝐪𝐮𝐢𝐫𝐢𝐞𝐬 𝐨𝐧 𝐲𝐨𝐮𝐫 𝐜𝐫𝐞𝐝𝐢𝐭 𝐫𝐞𝐩𝐨𝐫𝐭

This is a red flag that gives the impression that you may be in financial trouble. Avoid applying for a surplus of loans, credit cards, or instances that would involve pulling your credit.

❌ 𝐇𝐢𝐠𝐡 𝐔𝐭𝐢𝐥𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐑𝐚𝐭𝐞

This can give the impression that you’re not able to pay for your obligations. Try to keep your utilization rate below 30% and make payments each month or in full if possible.

P28

Saving up to buy a home? Here are three tips that can help you save:

.

1) Attack that debt: Begin with your smallest debts and work your way up to the largest. This is called “The Snowball Method” and it has been proven to work wonders!

.

2) Create an emergency fund: This is typically three to six months of expenses in case of emergencies. This way, if something comes up you won’t have to dip into that new home fund you’ve worked so hard to build up.

.

3) Establish your goal/wants: Make a list of the ideal neighborhoods, features you would want in a home, & then work with an experienced real estate agent & lender to set a realistic budget. If you’re getting a mortgage, aim for a monthly payment of no more than 25% of your monthly take-home pay.

P29

Credit score reports help lenders decide if they’ll give you credit or approve a loan.

These reports also help determine what interest rate they will charge you.

If you’re thinking about buying a home in the future, be sure to keep your credit in great shape. Otherwise, you could end up paying for it in the future – literally!

P30

Buyer Tip Time!

This may seem like an obvious tip but it is one that could make or break the deal on that house you have under contract. 🏡.

When you buy a home, you are going to start perusing new furniture to go in it, or maybe that stainless steel fridge at Home Depot that’s on sale, as well as all the other things that come with decorating and creating that cozy abode of yours.

However, before you head to that furniture store, be sure you make those purchases AFTER you close on your home, otherwise you could be left with a new living room set and no living room to put it in! 😳

P31

To calculate ‘how much house can I afford,’ a good rule of thumb is using the 28%/36% rule, which states that you shouldn’t spend more than 28% of your gross monthly income on home-related costs and 36% on total debts, including your mortgage, credit cards and other loans such as auto and student loans.

P32

Short Answer: Yes, and they’re rising fast.

Just three months ago, housing experts expected rates for the benchmark 30-year fixed-rate mortgage to clock in between 3.1 percent and 3.4 percent by this time.

What a difference a few weeks make: Rates have ratcheted up quickly since the beginning of the year, surging near 4.75 percent for the 30-year mortgage and just below 3.9 percent for the 15-year mortgage loan, according to Bankrate’s national survey of lenders.

Unfortunately for prospective buyers and refinancers, this costlier rate climate is probably the new normal, and all markers indicate higher mortgage rates in the weeks and months ahead.

P34

Choosing the right mortgage lender is a critical part of the biggest financial decision of many people’s lives.

You want to find someone who will not just help you find what you think you need, but will also inform you about the options you didn’t even know existed.

You want a professional who will point out and translate all of the fine print, so you can make an informed decision and understand the tradeoffs.

That’s why shopping around, reading reviews, getting recommendations & asking lenders questions are just a few ways you can go about making that important decision.